Palos Verdes Reed Market Report

We love numbers because they help us see where the market, was, is, and where it is going. Here, we present the year in review for the Palos Verdes Peninsula. How does your home compare? How did these sales affect the value of your home or property? We can show you. Please contact us for a confidential, no obligation valuation of your home. We can also assist you in other South Bay areas as well as Nationwide with our Complimentary Relocation Service. And remember, with our experience, organization and negotiation skills, we can make this process easier for you while maximizing your sales price, as we have done for other clients.

Please check back frequently for updates.

For a Complimentary Home Valuation, Please Click Here

PALOS VERDES OVERVIEW

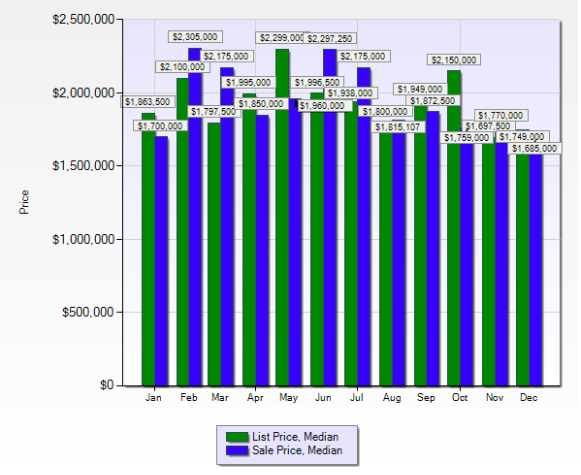

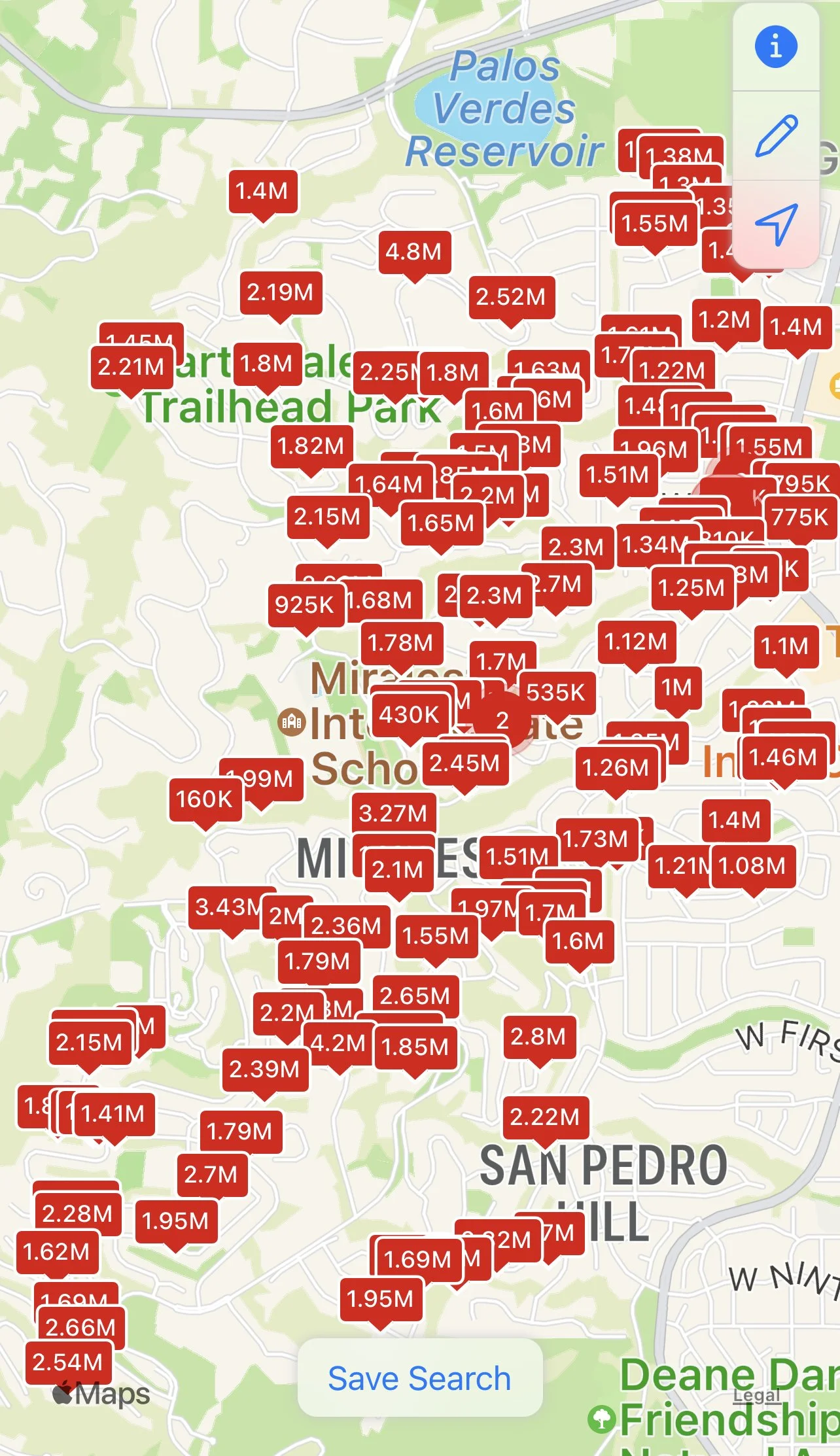

Overall, there were 618 single family homes and 169 townhomes and condos sold in Palos Verdes in 2022. These were for listed properties. Of the single family homes, 35% saw a price decrease and 54.5% saw a price increase. The remainder sold at the asking price. The chart below shows the comparison between the median asking price (green) and the median sold price (blue). for the most part, sale prices were highest through July. There was a sharp drop in August and remained steady with gradual declines through December. This drop coincides with the increase in the home loan interest rates, hovering ultimately, in the 7% range.

On the upside, 3 of our 4 cities saw increases in pricing from 8.2 to 17%. Given the value of homes, investment in real estate can outperform the stock market.

Now that we are in January 2023, we are seeing the interest rates declining and expect to see them continue to decline possibly to the 6% range by mid 2023. The decline in rates will bring in more buyers and will encourage home owners to sell. A seller can still sell at a good price and buy or with certain vendors with whom we work, we can facilitate a purchase first and then the sale. In other scenarios sellers may wish to sell first, stay in their home for a period of time and then purchase. We provide options and can help with all these scenarios.

And Buyers can still capitalize on owning a property by taking advantage of different loan programs. In addition, while perhaps not taking a major cut in price, about 30% of sellers, nationwide, assisted buyers by providing credits towards decreasing the buyers’ interest rates. For example, a popular option is the 2 / 1 buydown where the interest rate (eg, 7%) is brought down by 2% in year 1 of the loan (lowering it to 5%) and then 1% in year 2 of the loan. (lowered to 6%). At year 3, the loan goes back to the original rate of 7%. (or whatever the original rate is). It’s a win for sellers because they don’t need to vastly decrease their asking price and can still attract buyers. And it’s a win for buyers because they can use the savings for other items and more importantly, they can afford the home they want.

For more information on downsizing, obtaining your next home, or purchasing a home for a child or as an income property, please contact us.